When the stock market takes a tumble, it can be nerve-wracking to see your portfolio drop in value and tempting to pull your money out of before stock prices fall any further.

If you’re worried about losing money during this market downturn, you’re not alone. There is one simple and effective way to protect your savings: don’t panic.

Here are a few ways to avoid losing money when the market takes a downturn.

1. Don’t overreact during times of uncertainty

The problem is that the human reaction, to good news or bad news, is to overreact. This emotional reaction causes illogical investment decisions. This tendency to overreact can become even greater during times of personal uncertainty—near retirement, for example, or when the economy is bad.

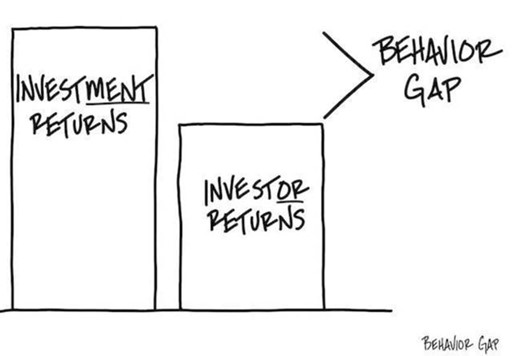

There is an excellent book called The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money by Carl Richards that illustrates this point very well. He states “we’re wired to avoid pain and pursue pleasure and security. It feels right to sell when everyone around us is scared and buy when everyone feels great. It may feel right – but it’s not rational.” Richards’ behavior gap theory suggests that many investors earn lower returns not because of the investments they choose but because of the way they use those investments. If these investors behaved differently while still using these same investments, they would experience better results.

The 2022 QAIB report [1] reaffirms this research and found that investors who remained patient and didn’t focus on short-term market ups and downs were significantly more successful than those who let their emotions override their longer-term strategy to build wealth. This report shows that people are more often than not their own worst enemies when it comes to investing, often succumbing to short-term strategies such as market timing or performance chasing.

2. Be boring

In the midst of uncertainty, boring is beautiful.

Consider adding bonds, defensive and/or dividend paying holdings to your portfolio. They are not the glamorous, talk about them at the water cooler type of investment but they are great to have in your portfolio during difficult markets.

- In a market downturn, defensive stocks—consumer staples, healthcare and utilities, as well as companies with higher-quality businesses and balance sheets—potentially can offer opportunities.

- You might also find opportunities in higher-quality stocks that pay dividends, especially ones that have historically grown their dividends consistently; they may potentially help to boost your total return when stock prices may be falling. Dividend producing investments can help mitigate market volatility and bolster returns when inflation is rising.

- Bonds also offer investors income, diversification, inflation protection and a measure of stability when equity markets are volatile.

3. Do nothing

Just as you wouldn’t run out and put a for-sale sign on your home when the housing market turns south, don’t rush to sell your investments when the stock market goes through a down cycle. Wait it out.

A conscious and thoughtful decision to do nothing is still a form of action. Have your financial goals changed? Most likely not. If your portfolio is built around your long-term goals, a short-term change in markets doesn’t matter – it’s a long term plan.

It is important to note that there is a difference between a realized and unrealized loss.

- Realized gains/losses are incurred as a result of an actual sale of that investment.

- Unrealized gains/losses are hypothetical values of that investment if it were to be sold at that specific point in time. Your account value may have decreased, but that doesn’t mean you have actually lost money.

The balances you see on your investment statement are called unrealized losses or gains. If you hold your position and do not sell, you create an opportunity for that investment to bounce back.

To quote a famous economist, Eugene Fama Jr., “Your money is like a bar of soap. The more you handle it, the less you’ll have.” Stick with your investment plan and don’t keep adjusting your portfolio to time the market. The reason this do-nothing strategy works is that you aren’t technically losing any money, unless you sell. Your portfolio might lose value, but losing value is different than losing money.

4. Invest more

Yes, this may sound like the exact opposite of what I just recommended in point above, but it isn’t. If you have an investment plan and did the research to find good stocks to own, specifically those you intend to hold long term, don’t change course, add to these holdings.

Long-term investors consider down markets as an opportunity to add to their portfolios; they put their money in stocks where they have belief in that company and its long-term projections. Down markets and stock market crashes put good companies on sale. Right now, your portfolio has taken a big hit, but if you believe in the stocks you own then holding them and adding to those positions makes sense.

As a note, it is good to check in on you stock or investment holdings to make sure there hasn’t been any fundamental changes to it that caused it to diverge from why you own it. For example, did the CEO change and the new leader made a major change to how the company operates? Did something huge happen in the market that causes you to change how you see the company’s prospects. If nothing has changed, then why not double down and add more money while it is on sale?

5. Use a professional

One of the best things you can do to protect yourself from your own natural tendency to make emotional decisions is to seek professional help and hire a financial advisor. An advisor can serve as an intermediary between you and your emotions.

If you feel as though your emotions are getting the better of you or you simply do not know if your holdings are appropriate, consider reaching out for professional advice. An advisor can help you review your financial approach and offer investment insights that may help limit the effect that a market downturn could have on your short- and long-term goals. And as the markets recover, your advisor can continue to help you stay on track, working with you to adjust as your priorities change over time.

If you are going to retire ten or more years from now, a down market shouldn’t make you sweat – good things can come out of these times. So don’t be so quick to get out of a stock, just keep monitoring the holding for its vital statistics (growing sales and profits and so on), and if the investments look fine, then hang on as it zigzags into the long-term horizon.

[1] Dalbar, Inc. “2020 QAIB Report.”